DOWN PAYMENT REQUIREMENTS FOR ONTARIO

Are you looking to buy a home in Ontario? One of the first hurdles you'll encounter is the down payment. Whether you're a first-time homebuyer or upgrading to a larger place, understanding down payment requirements is crucial to your real estate journey.

First-Time Homebuyers in Ontario:

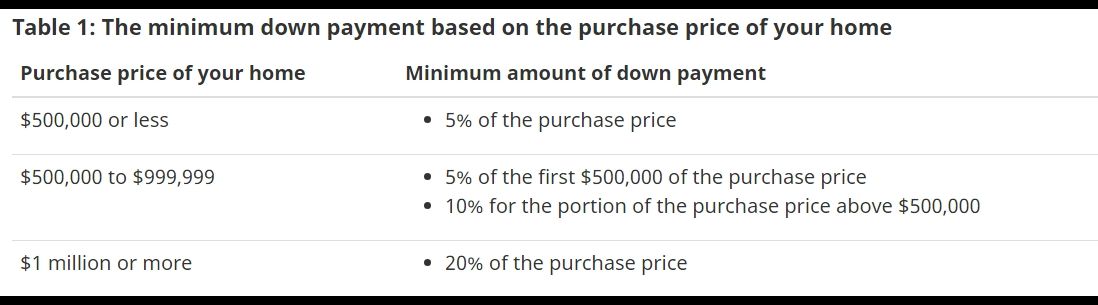

If you're a first-time homebuyer in Ontario, the down payment requirements can vary based on the home's purchase price.

For properties costing $500,000 or less, a minimum down payment of 5% is required.

If the purchase price is between $500,000 and $999,999, you will need to put down 5% on the first $500,000 and 10% on the remaining amount.

For homes priced at $1 million or more, a 20% down payment is mandatory.

Repeat Buyers:

Even if you've gone through the homebuying process before, it's important to review the down payment rules again.

The requirements generally remain the same as for first-time buyers, but keep in mind that your financial situation may have changed since your last purchase.

Higher down payments can also help you avoid additional costs like mortgage insurance.

Mortgage Loan Insurance:

If your down payment is less than 20%, mortgage loan insurance is required, provided by either CMHC, Sagen, or Canada Guaranty.

This insurance protects the lender in case you default on your loan and adds an additional cost, impacting your monthly payments.

Government Programs and Incentives:

Ontario offers various programs to help ease the financial burden on buyers. The Home Buyers’ Plan (HBP) allows you to withdraw up to $35,000 from your RRSPs to finance your down payment without incurring immediate taxes.

The First-Time Home Buyer Incentive (FTHBI) offers a shared equity mortgage with the Government of Canada to further reduce monthly expenses.

Planning Your Down Payment:

It's essential to plan and save for your down payment well in advance. Use savings, investments, or even financial gifts to build your fund. Ensure to consult a financial advisor or mortgage broker to explore all your options.

In summary, knowing the down payment requirements for Ontario ensures you're prepared to buy your dream home. Work with a knowledgeable realtor to navigate these rules, understand related costs, and explore government incentives available to you. Happy house hunting!

Book Your Home Buyer Consultation Today:

https://calendly.com/tish_s/home-preview-buyer-plan-meeting-clone

View All Homes for Sale Here:

Homes for Sale - Tish Schobourgh - eXp Realty

Categories

Recent Posts